Visa Chargebacks Chargebacks are the reversal of charges made to your credit card, and even though they are a basic right based on American legislation dating back almost half a century, the practical application of these rights vary considerably among the different card networks.

Full Answer

What happens if there is a chargeback?

Chargebacks have both short and long-term ramifications for merchants. Each time a consumer files a chargeback, the merchant is hit with a fee ranging from $20 to $100 per transaction. Even if the chargeback is later canceled, the merchant will still have to pay fees and administrative costs.

What to know about visa's New chargeback rules?

Visa's New Chargeback Rules: What You Need To Know

- Get Ready For New Chargeback Rules. If one of your customers has ever disputed a transaction, you understand how frustrating the chargeback resolution process can be.

- The "VCR" Initiative. Visa refers to its new chargeback rules as the Visa Claims Resolution ("VCR") initiative. ...

- You Are In Control. ...

What do chargebacks mean to issuers?

The debit card or credit card chargeback process begins when a cardholder submits a request to dispute a transaction with the merchant to the bank that issued the card. The technical term for your bank is the issuing bank. Once the issuing bank accepts your request, it will raise a dispute with the merchant’s bank.

How much is a chargeback fee?

When a chargeback happens, the merchant is hit with a chargeback fee, which typically ranges from $20 to $100. The more chargebacks you get, the higher the fee. If you have too many chargebacks in a short period of time, you could lose your merchant account that enables you to process credit card payments.

What does Visa chargeback mean?

What Are Visa Chargebacks? When a cardholder files a dispute with the issuing bank that provides their Visa-branded credit card, the transaction becomes a Visa chargeback, also known as a Visa dispute. The bank debits the transaction amount from the merchant and gives the cardholder a temporary credit.

How does a chargeback work?

When a chargeback happens, the disputed funds are held from the business until the card issuer works things out and decides what to do. If the bank rules against you, those funds are returned to the cardholder. If the bank rules in your favor, they'll send the disputed funds back to you.

Does chargeback hurt your credit?

Chargebacks won't affect your credit scores. But an account might say “in dispute” on your credit reports during the investigation period.

Is a chargeback the same as a refund?

Generally, you'll have two options when disputing a transaction: refund or chargeback. A refund comes directly from a merchant, while a chargeback comes from your card issuer.

How long does a Visa chargeback take?

From start to finish, disputing a charge can often take 45 to 90 days. Whenever possible, however, Visa prefers to have customer disputes finalized in a month or less. This means that merchants need to respond to each phase as quickly as possible.

Do customers always win chargebacks?

Chargebacks are easy to initiate and are often successful, but they don't cover all scenarios. Chargebacks are designed as a last resort; the first step should generally be to try to resolve the issue with the merchant directly.

How common are chargebacks?

Across all industries, the average chargeback to transaction ratio is 0.60%. This translates to 6 out of every 1000 transactions will be a chargeback. Retail and travel industries have about a 0.50% chargeback rate. Merchants who sell physical goods tend to have a chargeback ratio at or below 0.5%.

Can you get in trouble for chargeback?

Merchants can take customers to court over fraudulent chargebacks, and many jurisdictions will pursue criminal charges for chargeback-related fraud.

What happens if you lose a chargeback?

For merchants who have lost their chargeback dispute during any of the three cycles, or decided not to contest the chargeback, they are out the money from the sale, the product sold, plus any fees incurred. Once a merchant loses a chargeback, the dispute is closed and they can't petition any further.

What happens during a credit card chargeback?

A chargeback is an action taken by a bank to reverse electronic payments. It involves reversing a payment and triggering a dispute resolution process. Generally, chargebacks occur between a merchant and a credit card issuing bank or a consumer.

What are the reason for chargeback?

Most Fall in the Middle There are three fundamental chargeback sources: merchant error, criminal fraud, and friendly fraud.

How do I get a Visa chargeback?

Contact your card provider to make a claim A good place to start is to visit your card provider's website and look for details on 'disputed transactions' or 'chargeback claims'. If you can't find it, get in touch with your card provider and tell them you want to use the 'chargeback scheme'.

Can a bank refuse a chargeback?

If your Chargeback request is rejected, you've got a right to know why. If you think their decision is unfair you can complain to the bank. If they still refuse your claim, you've got six months to take your case to the Financial Ombudsman. The bank's decision might then be overturned.

What happens if you lose a chargeback?

For merchants who have lost their chargeback dispute during any of the three cycles, or decided not to contest the chargeback, they are out the money from the sale, the product sold, plus any fees incurred. Once a merchant loses a chargeback, the dispute is closed and they can't petition any further.

How often do merchants win chargeback disputes?

20 All merchants report winning 40 percent of disputed chargebacks on average. The true win rate average is actually 22 percent (56 percent average of fraud-related chargebacks disputed multiplied by 40 percent average win rate); however, the 27 percent average looks at the metrics on a merchant-by-merchant basis.

What happens if a merchant does not respond to a chargeback?

If the merchant doesn't respond, the chargeback is typically granted and the merchant assumes the monetary loss. If the merchant does provide a response and has compelling evidence showing that the charge is valid, then the claim is back in the hands of the consumer's credit card issuer or bank.

What is a chargeback on a credit card?

A Visa chargeback dispute is often to the benefit of the consumer since the burden of proof to indicate rightful purchase lies with the business.#N#In case the chargeback dispute is unsuccessful, the acquiring bank delays the payment for any chargeback dispute until it settles the matter.

How long does it take to chargeback a Visa?

However, some kinds of transactions define longer time before a chargeback can be initiated. For Visa its 540 days from transaction processing date.

What happens when a chargeback is initiated?

Firstly, once a chargeback claim is initiated, the issuing bank notifies the acquiring bank of the problematic transaction. The Visa Card holder’s account is credited the amount and the sales account has their funds withheld till the matter is resolved.

What to do if you get a chargeback from a merchant?

Therefore, if you feel the merchant has created a reason for chargeback, take the chance and recover your money.

Does every bank have a chargeback procedure?

Every bank, however, has its own specific procedure in dealing with a chargeback claim .

Is my chargeback easy?

In conclusion, the chargeback process can be complicated and mistakes can cost you. MyChargeback.com makes the process simple and easy, putting your money back where it belongs – in your wallet.

What is chargeback in credit card?

Chargebacks should be the next step if asking the merchant for a refund doesn’t work. You initiate a chargeback directly with your card issuer in the hopes of the transaction being reversed.

What is a chargeback?

Chargebacks are a consumer protection tool that allow consumers to get their money back for fraudulent charges or purchases that don’t live up to standards by submitting a dispute with their card issuer.

What to do if you notice a transaction on your credit card?

Generally, you’ll have two options when disputing a transaction: refund or chargeback. A refund comes directly from a merchant, while a chargeback comes from your card ...

What does the card network do?

The card network reviews the transaction and either requires your card issuer to pay or sends the dispute to the merchant’s acquiring bank. The merchant’s acquiring bank takes one of two actions: Sends the dispute back to the card network and says the issuer is at fault or forwards the dispute to the merchant.

What happens when you submit a chargeback request?

Once you submit a chargeback request, the exact process varies depending on your card issuer, network and situation, but generally results in some back-and-forth between various parties. Here’s an example of how the process may go, according to Experian: You file a chargeback request.

What happens if a merchant gets a chargeback?

If the merchant gets it, they either agree to pay for the transaction or dispute the chargeback.

What happens if you pay for something but never received it?

If you paid for an item but never received it, or it arrived damaged, you may be frustrated and want your money back, justifiably. As a result, you may try to dispute it with your credit card issuer through the process of a chargeback.

What Is a Chargeback?

A chargeback is a charge that is returned to a payment card after a customer successfully disputes an item on their account statement or transactions report. A chargeback may occur on debit cards (and the underlying bank account) or on credit cards. Chargebacks can be granted to a cardholder for a variety of reasons.

What is chargeback initiated by a merchant?

For example, a chargeback initiated by a merchant would begin with a request sent to the merchant’s acquiring bank from the merchant.

How does a chargeback work?

If a chargeback is initiated by the issuing bank, then the issuing bank facilitates the chargeback through communication on their processing network. The merchant bank then receives the signal and authorizes the funds' transfer with the confirmation of the merchant.

What is chargeback reversal?

Chargebacks can be granted to a cardholder for a variety of reasons. In the U.S. chargeback reversals for debit cards are governed by Regulation E of the Electronic Fund Transfer Act. Chargeback reversal for credit cards are governed by Regulation Z of the Truth in Lending Act.

How long does it take for a chargeback to be settled?

Focused on charges that have been fully processed and settled, chargebacks can often take several days for full settlement as they must be reversed through an electronic process involving multiple entities.

Why are charges disputed?

Charges can be disputed for many reasons. A cardholder may have been charged by a merchant for items they never received, a merchant could have duplicated a charge by mistake, a technical issue may have caused a mistaken charge, or a cardholder’s card information may have been compromised.

What is a chargeback in Visa?

Visa describes the chargeback—or dispute—as a way of giving issuers a channel for undoing a disputed transaction. In simple terms, chargebacks are forced payment reversals initiated by the cardholder’s bank. You can think of them as mandatory refunds that happen without the merchant’s consent.

What does a chargeback mean on a Visa card?

Chargebacks typically start when cardholders don’t recognize a transaction on their Visa monthly statement. Ideally, they would—and should—call the merchant at this point, but it’s understandable that the initial reaction might be to contact the card-issuing bank to see if the transaction was valid.

What is Visa chargeback policy?

Another one of Visa’s chargeback regulations mandates that merchants have clearly defined refund, return, and cancellation policies, all of which are easily accessible to customers. This works to the merchant’s benefit, as misreading a business’s refund and return rules is one of the most common reasons cardholders give for disputing a transaction.

What is TLS 2 for Visa?

Some of the most important Visa chargeback regulations deal with the protection of cardholders’ personally-identifiable information. For example, Visa requires all clients to use Transport Layer Security (TLS) version 1.2 encryption to connect to any Verified by Visa hardware. TLS 2 is more secure and looks to become the accepted standard, as Apple, Google, Microsoft, and Mozilla have all announced that their browsers will cease support for TLS 1.0 and 1.1 as of March 2020.

What happens if a Visa chargeback is legitimate?

If a chargeback seems legitimate, the cardholder’s issuing bank must return the transaction to the merchant’s acquiring bank, officially disputing the dollar amount of the transaction. Visa chargeback policies state that the acquirer then investigates the circumstances of the transaction to see if the chargeback is valid.

How long does it take for a Visa to return a receipt?

All the responses in this process must happen within a tight timeframe, dictated by Visa chargeback regulations. The acquirer has just 30 days from the date it receives the retrieval request to return a receipt copy to the issuer. If the acquirer must request the receipt from the merchant, the merchant’s response window will be even shorter.

What is a VCR?

In 2018, Visa rolled out a new global dispute process titled Visa Claims Resolution , or VCR. The new system was designed to reduce timelines and simplify the chargeback dispute process by shifting from the old litigation-based model to a liability assignment model.

What is the Visa Chargeback Threshold?

The company revised their standards with recent rule changes, though. They established thresholds for standard, “early warning,” and “excessive” tiers. Visa bases the standards for each tier on two criteria: your chargeback ratio, and the total number of chargebacks you received.

How to calculate Visa chargeback rate?

Calculating your Visa chargeback rate starts with the number of chargebacks you get in a single month. Next, divide that figure by the total number of transactions in the same month:

What happens if a Visa chargeback is spiked?

When customers or their issuing banks file disputes, Visa first overturns the transaction from your acquirer. In turn, your acquirer then withdraws the money from your account to cover their loss. However, if your chargeback issuances spike, or your liabilities outstrip the amount of cash you have available on hand, the acquirer would be held liable to cover the outstanding chargeback costs. To protect their interests, most acquirers will preemptively cut you off if there’s a chance that this might happen.

What happens if you breach the Visa chargeback threshold?

If you breach the Visa chargeback threshold, they will assess a $50 per-chargeback fine with each new dispute. If you can’t bring your chargeback rate down within a year, you may have your card processing privileges revoked entirely.

What happens if your Visa card is frozen?

Of course, if your merchant account is frozen or canceled, you’ll be unable to process card payments.

How long is the grace period for Visa chargebacks?

Going over the standard threshold is more serious. You’ll receive a four-month grace period in which to get your chargeback ratio under control. If you fail to do so, Visa will begin assessing a $50 per-chargeback fine with each new dispute. What if you can’t bring your chargeback rate back under the standard Visa chargeback threshold within a year, though? You might have your card processing privileges revoked.

What is the goal of Visa?

The goal here is for Visa to protect themselves and mitigate risk. They also want to ensure that your sales tactics are ethical and your methods and technology are compliant with card network protocols.

What is a chargeback on a Visa card?

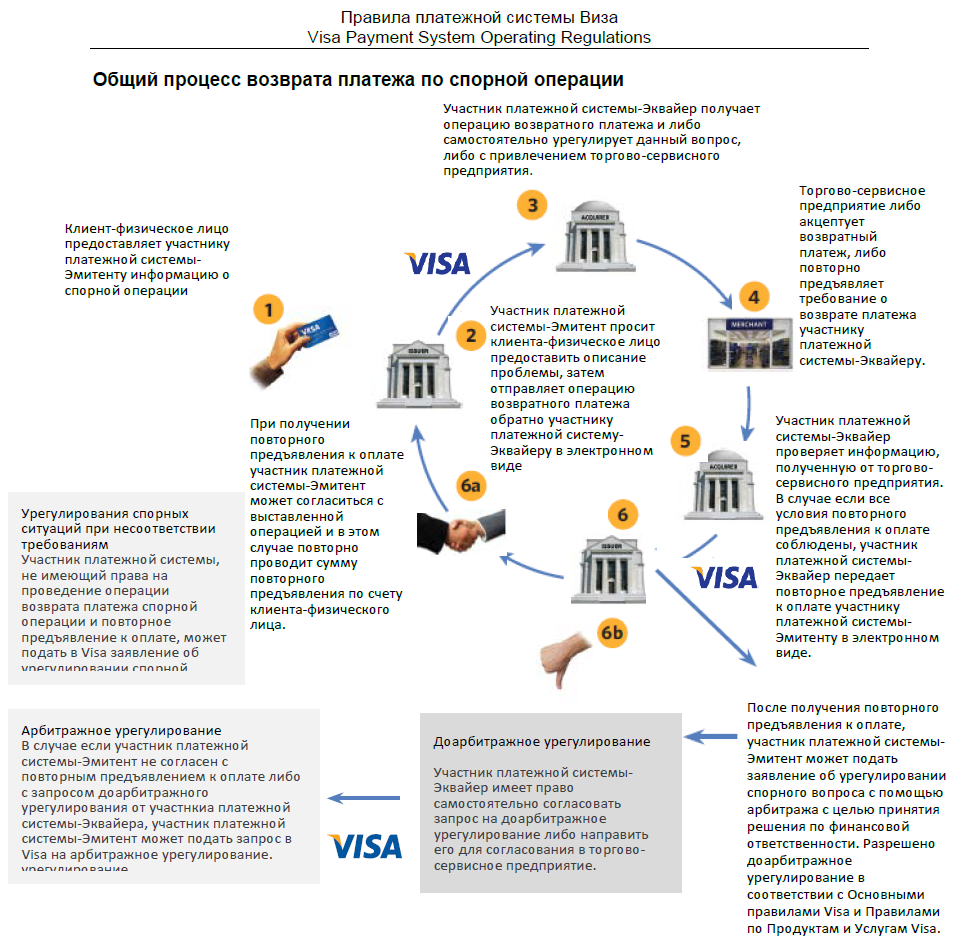

When a Visa cardholder files a dispute, a transaction is turned into what is known as a Visa dispute. Visa disputes (aka chargebacks) are governed by rules set out by Visa. The chargeback process includes several steps.

What is a chargeback?

A chargeback is an act initiated by a cardholder to dispute a debit or credit card charge they believe to be illegitimate. When a chargeback occurs, a forced reimbursement of a transaction is initiated by the card issuer. Chargebacks can happen at any time after a sale occurs; however, they are most common within the first 120 days.

How does a chargeback work?

The chargeback process is set and managed by card networks and must be followed by financial institutions and merchants. The parties involved in the chargeback process include:

How can Pay help reduce chargeback disputes?

Pay.com enables merchants to increase conversions with a secure, fraud-resistant checkout that prevents certain fraud chargebacks and brings your business fully in line with the latest PSD2 legislation. With a 3D-secure component, our system decides how risky each transaction is based on the amount being spent and whether the shopper is known to your store. Regular/familiar customers and those spending an expected amount are “exempted” from extra security measures. Only unfamiliar customers, large sums, and suspicious behavior is subject to more stringent checks. To find out more about how Pay.com helps protect you from fraud-based chargebacks - sign up now!

How to handle chargebacks?

As a merchant, you should always be ready to respond to chargebacks because they are bound to happen regularly. One of the most important things to handle chargebacks efficiently is staying organised and having good record-keeping practices. That way, if a customer disputes a charge on their card, you can be ready to fill out the required forms and respond as quickly as possible as soon as you’re notified of a claim. Without good record-keeping practices or the authenticating information necessary at the time of purchase, handling chargebacks can become extremely cumbersome and time-consuming. It’s also essential to know why the chargeback occurred in the first place. To do this, you’ll need to understand the reason code, which is attached to the transaction by the issuing bank. However, as a merchant, you also need to understand that you can’t afford to simply accept chargebacks. You’ll need to defend any valid transactions and recover lost revenue, requiring you to follow the chargeback representment process. Chargeback representment is a regulated process for responding to unwarranted chargebacks.

What happens if a customer files a chargeback claim for late delivery?

If a customer files a chargeback claim for late delivery, they must first try to get a return. A chargeback is only possible if both the return and refund are denied.

How long do you have to charge back a credit card?

Cardholders have 120 days from the day after the transaction date to file a chargeback for most issues.

What is chargeback in credit card?

A “chargeback” provides an issuer with a way to return a disputed transaction. When a cardholder disputes a transaction, the issuer may request a written explanation of the problem from the cardholder and can also request a copy of the related sales transaction receipt from the acquirer, if needed. Once the issuer receives this documentation, the first step is to determine whether a chargeback situation exists. There are many reasons for chargebacks—those reasons that may be of assistance in an investigation include the following: • Merchant failed to get an authorization • Merchant failed to obtain card imprint (electronic or manual) • Merchant accepted an expired card When a chargeback right applies, the issuer sends the transaction back to the acquirer and charges back the dollar amount of the disputed sale. The acquirer then researches the transaction. If the chargeback is valid, the acquirer deducts the amount of the chargeback from the merchant account and informs the merchant. Under certain circumstances, a merchant may re-present the chargeback to its acquirer. If the merchant cannot remedy the chargeback, it is the merchant’s loss. If there are no funds in the merchant’s account to cover the chargeback amount, the acquirer must cover the loss.

What is chargeback management?

The Chargeback Management Guidelines for Visa Merchants contains detailed information on the most common types of chargebacks merchants receive and what can be done to remedy or prevent them. It is organized to help users find the information they need quickly and easily. The table of contents serves as an index of the topics and material covered.

How to get a copy of a credit card transaction?

When a card issuer sends a copy request to an acquirer, the bank has 30 days from the date it receives the request to send a copy of the transaction receipt back to the card issuer. If the acquirer sends the request to you, it will tell you the number of days you have to respond. You must follow the acquirer’s time frame. Once you receive a copy request, retrieve the appropriate transaction receipt, make a legible copy of it, and fax or mail it to your acquirer within the specified time frame. Your acquirer will then forward the copy to the card issuer, which will, in turn, send it to the requesting cardholder. The question or issue the cardholder had with the transaction is usually resolved at this point. Note: When you send the copy to the acquirer, use a delivery method that provides proof of delivery. If you mail the copy, send it by registered or certified mail. If you send the copy electronically, be sure to keep a written record of the transmittal.

Why monitor chargeback rates?

Monitoring chargeback rates can help merchants pinpoint problem areas in their businesses and improve prevention efforts. Card-absent merchants may experience higher chargebacks than card-present merchants as the card is not electronic read, which increases liability for chargebacks.

What is Visa fraud?

The Visa Merchant Fraud Program monitors chargeback activity for all U.S. acquirers and merchants on a monthly basis. If a merchant meets or exceeds specified chargeback thresholds, its acquirer is notified in writing.

How to check your DBA?

You can check this information yourself by purchasing an item on your Visa card at each of your outlets and looking at the merchant name and location on your monthly Visa statement. Is your name recognizable? Can your customers identify the transactions made at your establishment?

What is an additional insight?

Additional insights related to the topic that is being covered. A brief explanation of the Visa service or program pertinent to the topic at hand.